2020 was a banner year for consumer app spending. It was one of the biggest mobile app trends of 2020. Many factors influenced this spike in-app revenues, but many experts thought it would drop this year as the pandemic began to wane. Alas, we now know that’s not the case.

The data points to spend continuing to trend upwards, which is great news for app companies. But what’s the reason for this? And will it cool down?

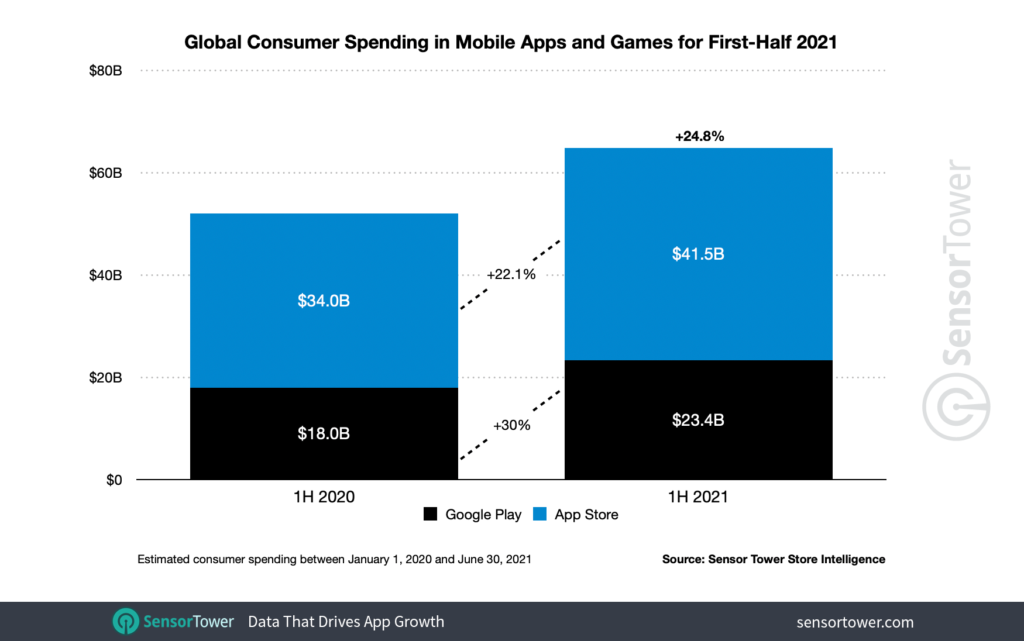

The First Half of 2021 Generated $64.9 Bill in Revenue

According to Sensor Tower, global consumer spending in mobile apps was $64.9 billion for the first half of 2021. This includes the Apple App Store and Google Play. The revenue consists of in-app purchases, subscriptions, and premium apps. That represents a 24.8 percent increase over 2020. Those are some big numbers.

Image: Sensor Tower

Apple App Store vs. Google Play

Apple is still dominating even though Google Play has a greater market share. Apple accounted for $41.5 billion to Google’s $23.4 billion. However, Google did experience more growth year-over-year at 30%.

Insights:

- Opening economies don’t translate to people spending less time or money on apps. They have likely become habits now. Consumers aren’t reverting to previous spending patterns.

- Apple users are bigger spenders, which is why many apps allocate more of their user acquisition (UA) budget here.

- Google’s growth represents more spending in areas where COVID-19 is keeping quarantines in place, such as the Philippines.

TikTok Tops the Revenue Charts

For both Apple and Google, TikTok earned the most revenue for non-gaming. This includes its equivalent Douyin on iOS in China. The projected spend in the app for January – June 2021 was $920 million, a 74% increase from 2020.

Insights:

- TikTokers spend on virtual coins to purchase virtual gifts for other users to show appreciation for their content. It’s not a subscription, nor is it actual merchandise. That’s an interesting dynamic for in-app revenue.

- TikTok currently ranks as the number seven most popular social media profile with approximately 732 million users. Its gaining users while many platforms are using them.

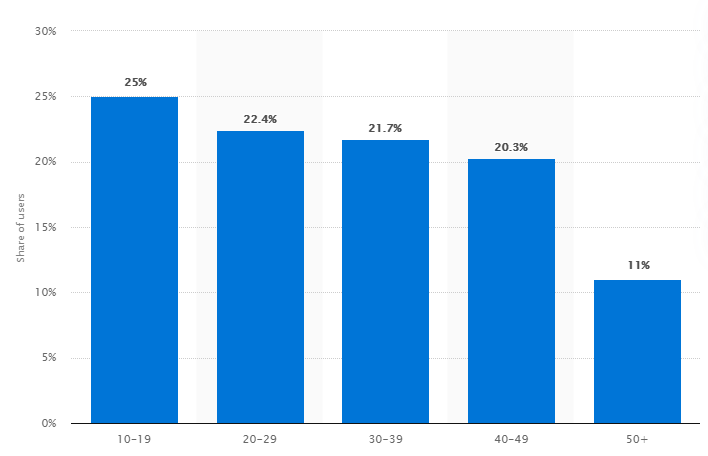

- All generations enjoy TikTok. It’s not just Gen Z or millennials. While its heaviest demographic is under 19, it’s growing in other segments, including those over 40.

Image: Statista

Other Leaders in the Non-Gaming Sector

Following TikTok were YouTube, Tinder, Piccoma, and Disney+. That’s a wide variety of categories. YouTube has streaming, as does Disney+. Tinder’s a dating app, generating revenue from mostly a la carte purchases of SuperLikes and specialty trading cards, while Piccoma is a Japanese comic reader, making money from subscriptions.

These are wildly different business models making bank from app spending. They each have a recipe that appeals to their target market.

App Installs Slightly Up for Google but Down for Apple

Even though spending is increasing, it’s not the result of more app downloads. Google only had a 1.7% increase from the first half of 2020. Apple was down 10.9%.

Insights:

- Apps don’t necessarily need more users to generate more revenue.

- Longer retention of users on apps typically leads to them spending more.

- Google’s slight increase may be due to Android prevalence in areas of the world where the pandemic is still raging, such as India.

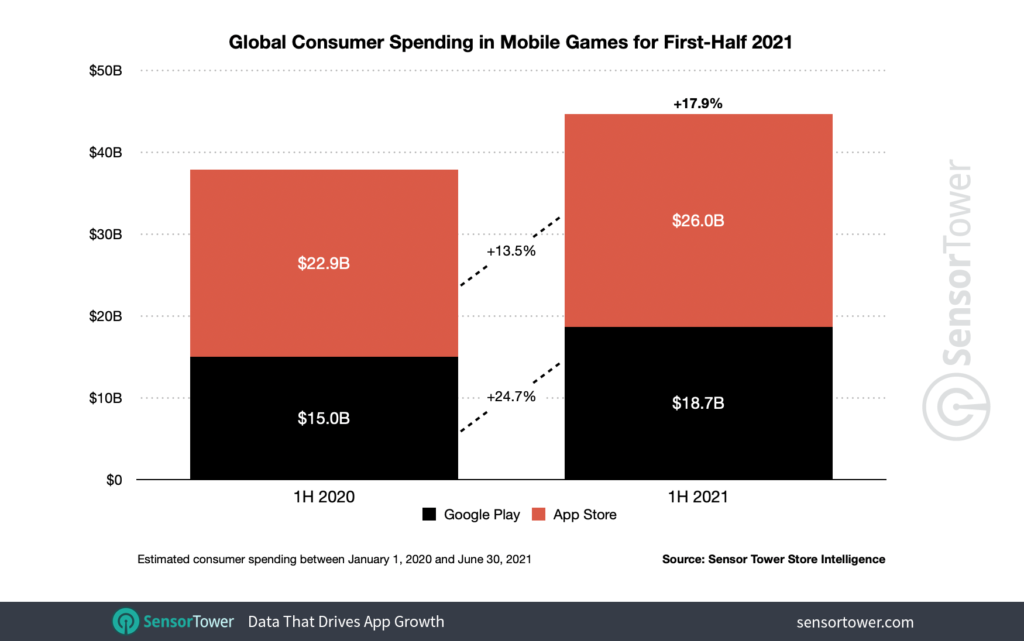

Mobile Game Spending Still Climbing

Mobile game spending was up considerably in the first half of 2021, reaching $44.7 billion. This is a 17.9 increase from 2020. Apple wins again on numbers alone at $26 billion versus Google’s 18.7 billion. However, Google’s YOY growth was 24.7%, while Apple’s was only 13.5%.

Image: Sensor Tower

Insights:

- Mobile game spending is growing, not at the same pace as 2019 to 2020, but it’s not declining. This could be a sign of the growth leveling out or normalizing.

- Google’s higher growth is again likely due to Android usage in areas where people are still quarantining.

China’s Tencent Continues to the Be the Highest Grosser

Tencent’s Honor of Kings took the overall title of the biggest earner. At number two was another of the company’s games, PUBG Mobile. Google Play’s top grosser was Coin Master.

Insights:

- Tencent is the king of mobile games right now, but a recent condemnation by China State Media calling Honor of Kings is “spiritual opium.” That sent their stock tumbling. Tencent’s response was to state they’ll institute stricter limitations on playtime for minors. We’ll have to see if it impacts in-app revenues.

Downloads for Games Aren’t Eclipsing 2020 Numbers Either

Apple had the most dramatic decrease at 22.8%. Google did see an uptick, but only at 3.9%.

Insights:

- It would be hard to keep up with the record pace of downloads from 2020.

- Fewer downloads don’t equate to less spending.

- Again, Google’s edge here is likely because of its market share in regions still facing quarantine and lockdowns.

Multiple Categories See Significant Growth

Book app revenue exceeded $1 billion for the first time. It’s up 58% over last year. Other categories with substantial increases include:

- Sports (65%)

- Finance (62%)

- Business (59%)

- Entertainment (49%)

Even though entertainment has the lowest growth, it still won on spend, reaching $4.4 billion.

Insights:

- Consumers are reading more, which is likely a continuing trend from the pandemic.

- Finance app spend increases align with previous data confirming greater adoption of Fintech apps.

Subscription App Revenue Hits $8.3 Billion

Subscription models are highly lucrative and cross all categories of apps. The first half of 2021 generated $8.3 billion, which is a 43% increase from 2020. Around 85% of non-game apps have a subscription offering.

Insights:

- Consumers continue to adopt subscription models, providing recurring revenue for apps.

- Any apps that don’t have a subscription option should highly consider implementing one.

Follow AdAction for What’s Next for Consumer App Spending

We’ll continue to follow the data on in-app purchase revenue and deliver insights to make sense of the data. For more great content for mobile app marketers, be sure to subscribe to our blog!