The mobile gaming industry is booming. In 2020, mobile gaming generated over $100 billion in revenue. The pandemic was an accelerator, but the category has long held the top position for uploads and engagement. In determining the performance of these apps, what mobile game analytics really matter?

It’s easy to see that it’s a saturated market. However, there’s room for success in attracting and retaining players. In your journey to understanding how well your mobile app game is penetrating the market, you’ll want to follow these mobile gaming metrics.

The Most Important Mobile Game Analytics to Track

Data is a powerful tool in the world of business. Collecting, aggregating, and analyzing it will deliver opportunities on what’s working. After all, if you don’t measure it, you can’t improve it.

Installs

Install metrics are critical for benchmarking your user acquisition (UA) tactics. It’s a base number that you need to calculate additional metrics. The number represents how many unique users download your app. Tracking by device type is important, too.

Once you have month-over-month or year-over-year data, you’ll be able to identify trends and patterns. These insights can inform you on many subjects, including the success of advertising campaigns or the effectiveness of your app store optimization (ASO) efforts.

Cost Per Install (CPI)

CPI is another essential measure. CPI calculations inform how you’ll grow, increase revenue, and choose advertising methods. It’s specific to a UA campaign, and the lower the number, the better, in most cases. CPI only looks at the cost of the initial install, not what happens to those players later.

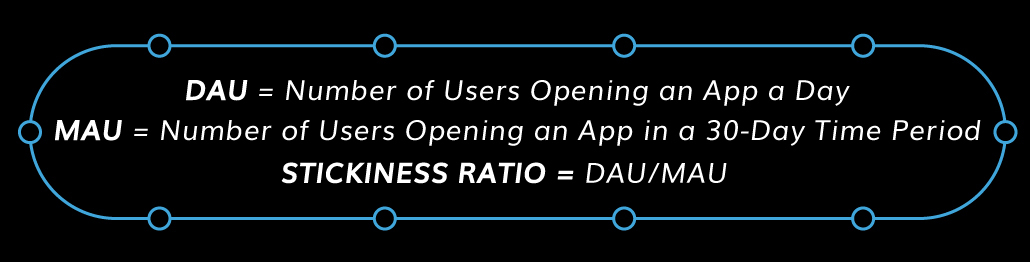

Daily Active Users (DAU) and Monthly Active Users (MAU)

This metric measures the number of daily users that perform an action on the app. It’s a good indicator of your apps’ stickiness, an industry term for user retention. It will lead you to understand if your app is part of a user’s daily life.

MAU describes the calculation of the number of unique players that interact with your app at least once a month. It can signal growth in UA and retention (or shrinkage). It won’t, however, tell a definitive story on engagement since a user only has to log in to be considered.

With both calculations, you can now evaluate stickiness. This ratio will let you know the number of days an average player logs in over the month.

Session Length

The amount of time a player spends on your app can tell you a significant amount about engagement. You’ll be tracking the player experience within a single session and could learn some insights about what keeps them playing, such as their interaction with offerwalls to earn more virtual currency.

In calculating, you should exclude idle time. By comparing session lengths for different cohorts, you can tap into why some are more engaged and account for in-app purchases (IAPs). In addition, it could help you build out targets for UA campaigns.

App Load Time

Could a slow app impact engagement and monetization? Yes, it could because it degrades the user experience. It can decrease session time and result in uninstalls. Think with Google estimates that the probability of a bounce increases 32% when load time goes from one to three seconds. To track this, you’ll need to, at intervals, open the app in iOS and Android.

If you find your app is slow, can you correlate it to a decrease in session time, DAU, MAU, or uninstalls? It’s certainly something you want to address and monitor.

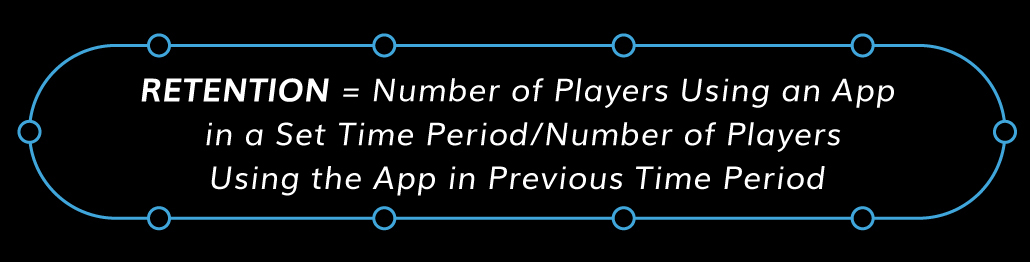

Retention

Retaining players after you acquire them ultimately determines the success of your app. You’ll calculate this by segmenting users by their Day 0 (day of installation) then tracking how often the user opens the app. Popular days to follow are Day 1, Day 3, Day 7, and Day 30.

Day 1 information advises you or your app’s first impression. At Day 7 players become more engrossed. Day 30 data will enlighten you on long-term retention.

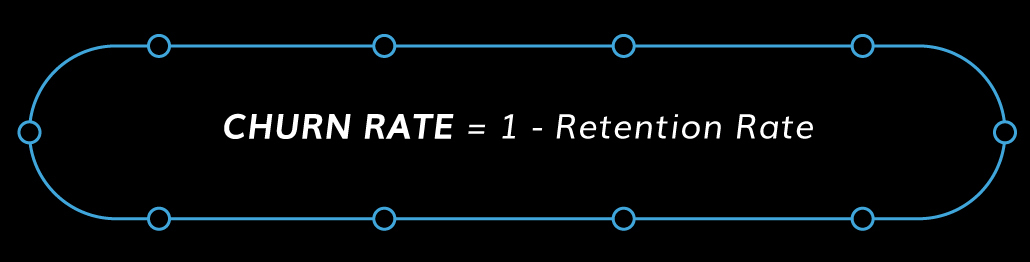

Churn Rate

Churn rate is a necessary evil in mobile game analytics. First, you need to know the percentage of players that abandon your app. Then, you can look at mobile app churn over the days identified above in retention.

You can see which intervals have the highest churn rate. For example, if you see high churn between Day 3 and 7, that tells you something about the experience after the initial install. It could help you position CPE (cost per engagement) campaigns that hook that back into your game.

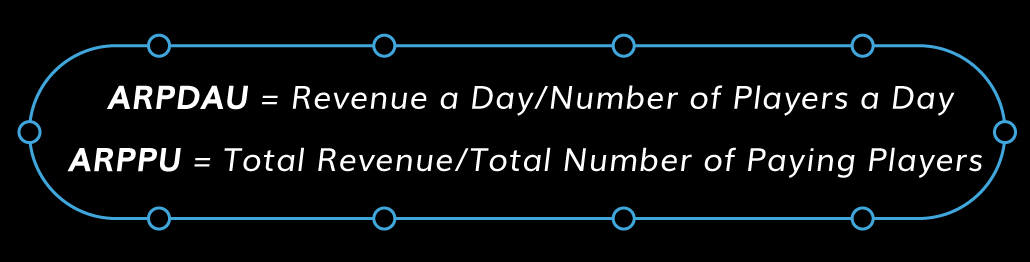

Average Revenue Per Daily Active User (ARPDAU) and Average Revenue Per Paying User (ARPPU)

These metrics are also about the money you’re making from users. ARPDAU defines the daily amount from a regular user. ARPPU is more specific, as it’s looking at revenue from a set of players (whales) that spend in-app.

For ARPDAU, you’ll want to calculate before and after UA campaigns. Post-campaign, then look at the segment of players spending and where they originated.

ARPPU will vary significantly, but that’s normal. It’s a direct response to your pricing model.

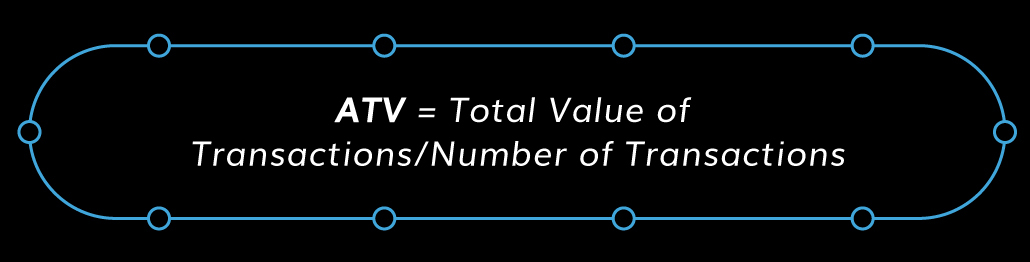

Average Transaction Value (ATV)

This next metric is a measure of revenue generation. It’s the amount a user will pay for an IAP. Knowing this can help you determine the right pricing for upgrades, virtual currency, or subscriptions. You should measure this consistently and note when you make price increases, which result in a boost, but this is a variable you introduced.

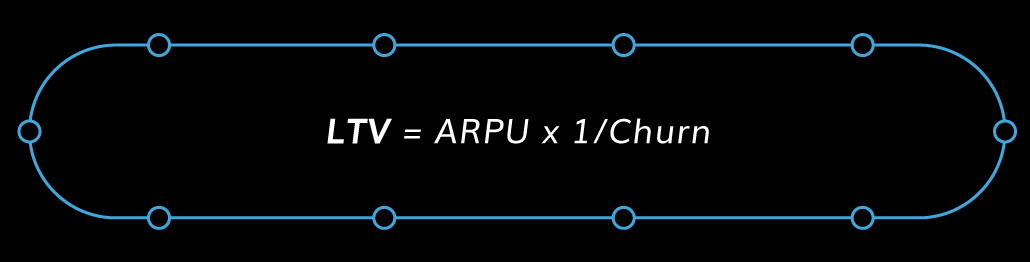

Lifetime Value (LTV)

LTV is one of the most critical mobile metrics. It will be a driver of your marketing strategy and offers clarity on margins. It can advise you of how much you should spend on CPI campaigns, which should be less than LTV.

Are Your Mobile Game Analytics Showing Strong Signals?

Mobile game metrics are the intelligence that factually defines the performance of all your advertising and monetization efforts. They tell the story of engagement, which can be a happy ending or a cliffhanger. Whatever signals they are indicating, you’ll have a course for improvement and optimization.

If your mobile game analytics aren’t where you need them to be, we can help. Talk to our mobile app marketing experts today.