The first quarter of 2022 is in the books, and there’s a lot to cover in app marketing. As the industry keeps evolving, so does the data. In this post, we’ll review some of the most important data points and deliver insights on how they’ll shape mobile app marketing.

Monthly Active Users Grow in Multiple Categories

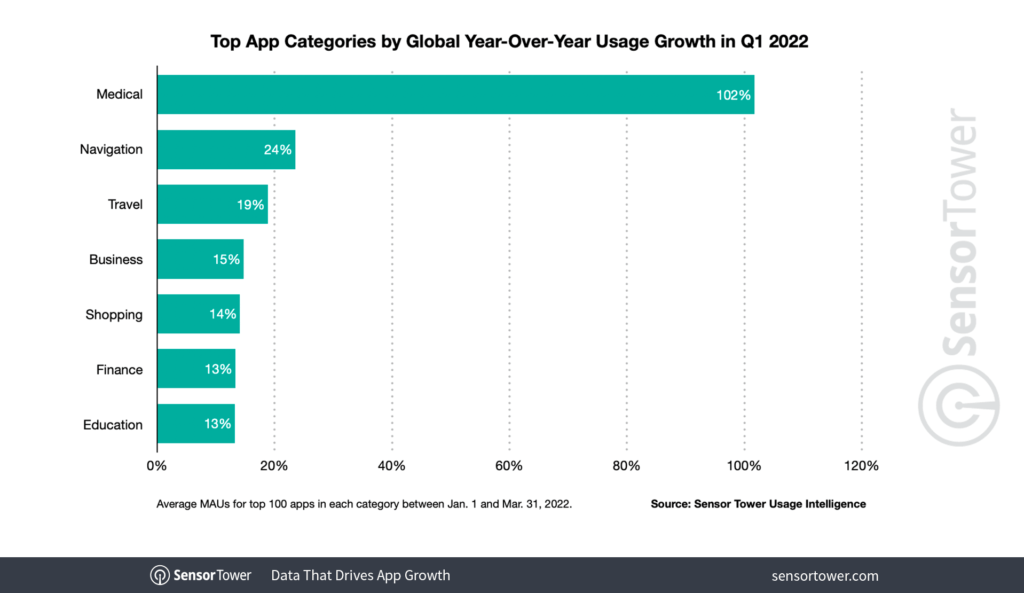

According to data from Sensor Tower, the number of monthly active users (MAU) grew by almost 5%. The top categories were medical, navigation, travel, and business. Medical actually doubled its MAUs.

Image: Sensor Tower

Key Takeaways:

- The pandemic continues to drive the surge in medical apps, with much user growth related to COVID-related apps like vaccine passports.

- Medical app usage is also higher as consumers become more comfortable with digitized health services.

- Increases in navigation and travel tie to a rebound for the industry. Much of the uptick was from users in parts of the world that have the virus somewhat controlled. The pent-up demand for travel is playing out in the app world.

- Business app growth correlates to the surge in hybrid work, as people rely on their smart devices to keep them connected.

Global Mobile App Revenue Stays Mostly Flat

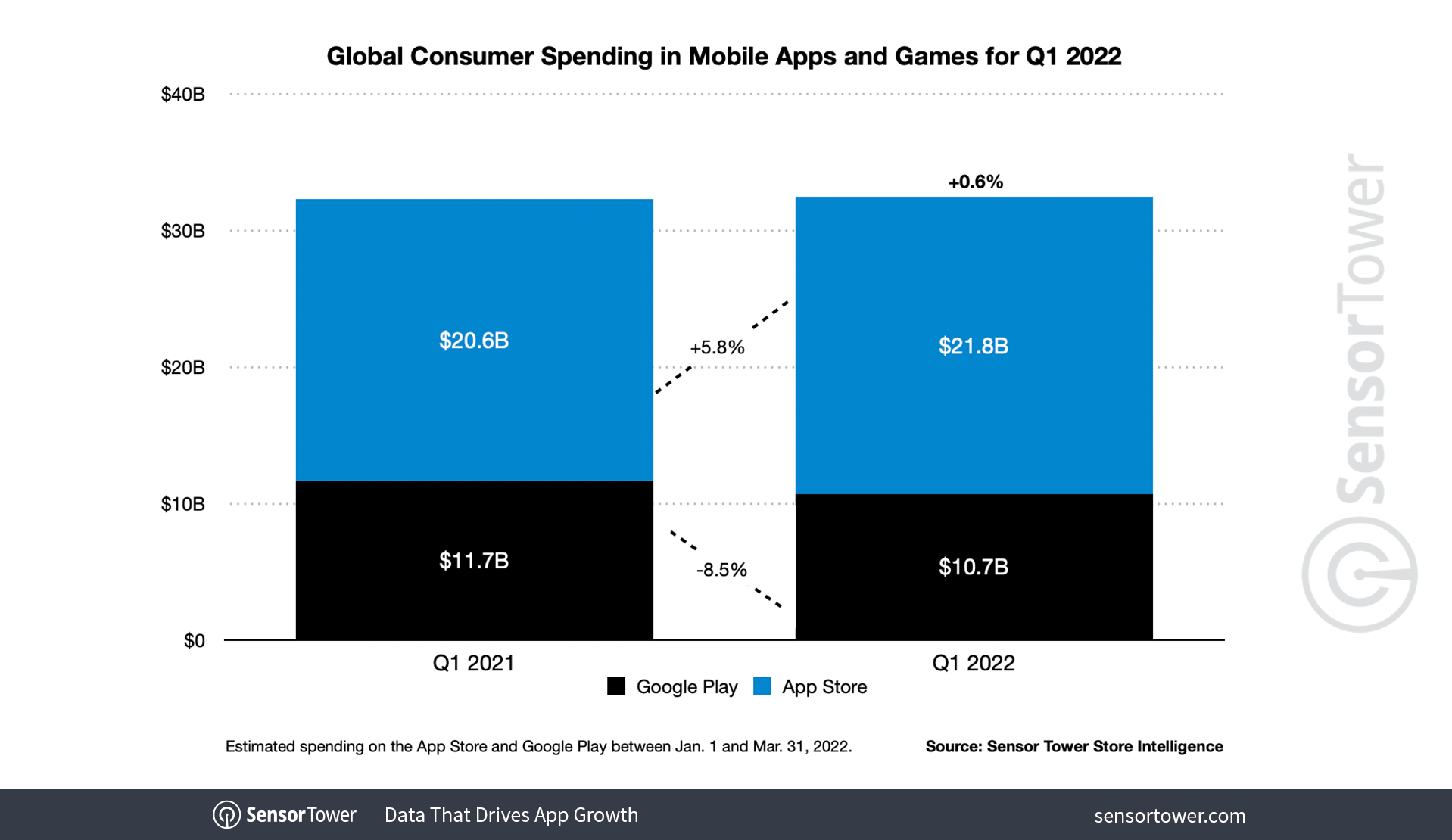

While 2021 saw record revenue in the app world, 2022 started flat. The total for in-app purchases (IAPs), premium apps, and subscriptions reached $32.5 billion in Q1 2022. That’s only a 0.6% increase year-over-year (YoY).

The App Store remained the leader with double the revenue of Google Play. When breaking down the numbers by medium, the App Store gained a billion, as did Google Play.

Image: Sensor Tower

Key Takeaways:

- Revenue did grow in Q1 2022, but it’s not as impressive as 2021 over 2020. However, the landscape is different now. Users have changing needs, and apps should address this in their value proposition.

- App marketers should rethink their subscription campaigns and try new approaches like CPI/CPE hybrids.

TikTok Leads Overall and App Store Revenue

TikTok took the top spot in Q1 2022 for overall and App Store revenue. It was in second place on Google Play behind Google One. TikTok generated $821 million across both stores. Other notable apps driving revenue were YouTube, Disney+, Tinder, and HBO Max.

Key Takeaways:

- TikTok has significant appeal and great influence on its users. That makes it an excellent medium for influencer marketing. No other social media app made the top 10 for either store.

- Streaming apps are still cashing in on consumers’ desire to watch from wherever.

App Downloads Remain Flat

In line with the smaller growth in revenue is download data. The first quarter saw 36.8 billion downloads, which was only a 1.1% YoY growth. While not impressive, it’s still a steady growth. In terms of apps gaining the most installs, TikTok was again at the top overall and in the App Store. However, Instagram led Google Play. Of the top 10 downloads, the majority were social media apps. Outside of that, Spotify made the top 10, as did video editor CapCut and retailer Shopee.

Key Takeaways:

- The devotion to social media remains, but users have more options now. That’s creating a tight grip on the download charts.

- Spotify seems to be the leader in streaming audio, despite controversies over content that had many users uninstalling.

Mobile Gaming Spend Declines but Installs Increase

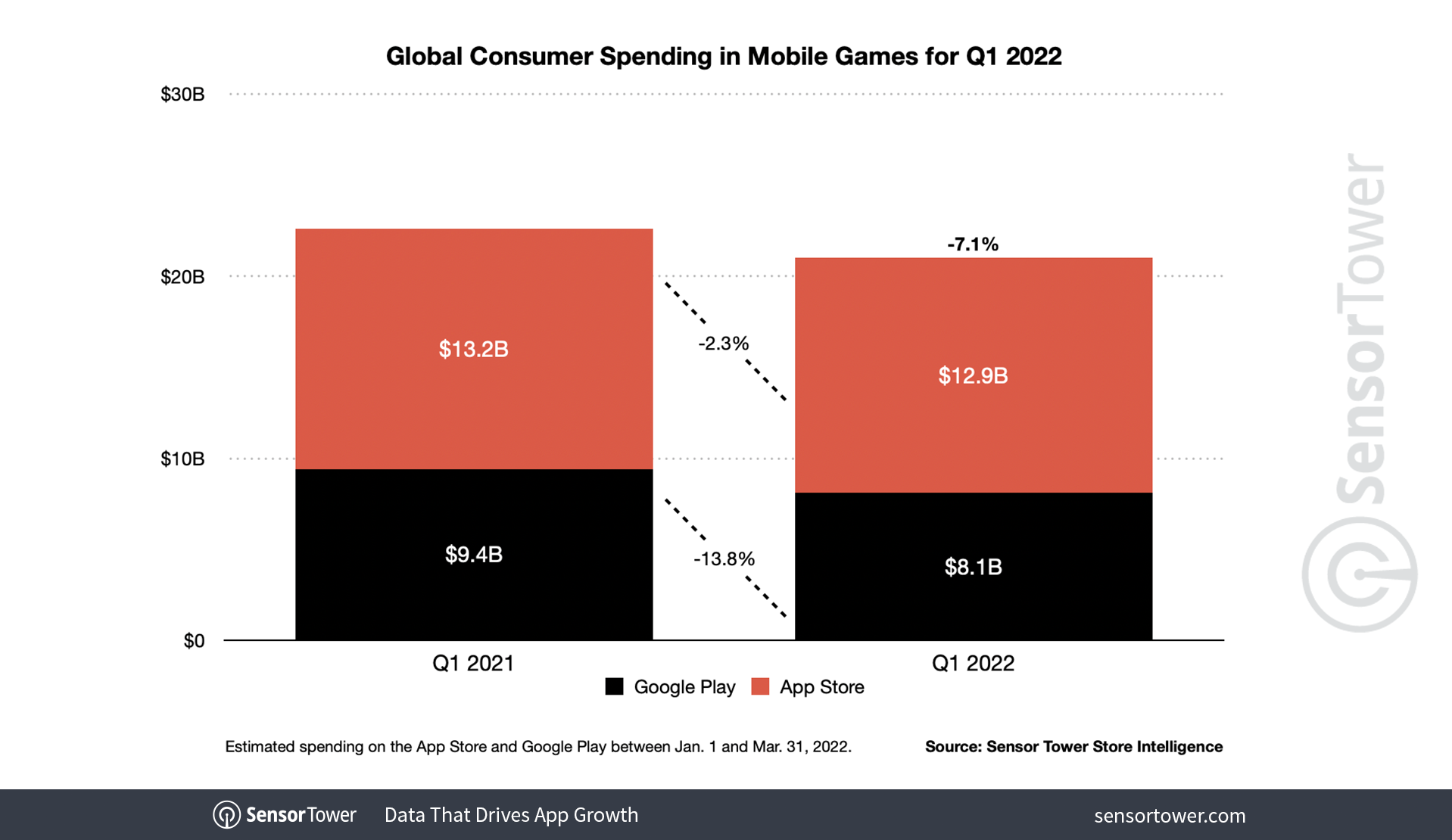

The bubble of mobile gaming spending seems to have popped. Sensor Tower reported a decline of 7.1% YoY overall. The most significant dip was Google Play. The top three highest-grossing mobile games were from Chinese publishers.

Image: Sensor Tower

Mobile games did gain more users for Google Play, which has a much greater market share. The App Store was flat. Garena Free Fire was the number one download, and the buzz around Wordle helped it earn the number two ranking on the App Store.

Key Takeaways:

- Spending on mobile games declined after many quarters of high revenue. As such, gaming apps will need to rethink their approach to monetizing players.

- The games that are the most popular are multiplayer battle royales. This aligns with the trend of mobile gaming as a social experience just as much as a gaming one.

Q1 2022 App Marketing Results Illustrate Normalization of Market

Both stores had significant growth in 2021, primarily due to the pandemic. The growth and decline numbers of Q1 2022 demonstrate a correction in the market. However, many apps with usage increases are related to the pandemic, so it’s not “over.” Further, the decrease in spending on games may reflect economic changes that result in less discretionary spending.

Understanding and capitalizing on these trends could boost your numbers. Find out how by connecting with our app marketing experts.