2022 App Marketing Roundup

Time flies in the world of mobile apps. It’s time to look back at Q2 2022 and dive into the numbers from SensorTower and what they mean. Mobile app marketing is an ever-changing industry with many factors impacting new user acquisition (UA), revenue, retention, and more. By understanding the major trends of this period, you’re sure to push through in the second half of the year to reach your marketing goals.

U.S. Consumers Spent More in Non-Games than Games for the First Time

Non-gaming spending accounted for 50.3% of revenue in the App Store. Most conversations around mobile app revenue start with the gaming categories. We know from historical trends that gaming apps have traditionally been those most likely to garner in-app purchases (IAPs).

More spending on non-games demonstrates a shift in consumer preference. It’s time to rethink where users place value. Overall, spending declined in Q2 2022 year-over-year. However, it was still up 71% compared to Q2 2019.

The growing subscription market is behind these new spending trends. It’s not just the giants in these categories, as 400 apps received more than $1 million in consumer spending in Q2 2022. That’s eight times the total in Q2 2016.

Key Takeaways:

- Gaming IAPs will always constitute a large amount of spend, but this gives other categories the chance to ramp up promotions with CPI (cost per install) and CPE (cost per engagement) campaigns that hit on what users need versus just leisure activities.

- If subscriptions are your primary revenue source, focus on goals around acquiring and converting. That can include a mix of app marketing and using multiple channels to engage new users. Your current non-subscribers should have a separate strategy that you segment based on the data you have on them. Offerwalls are a good mobile app marketing tactic.

Q2 Downloads Decrease Over Q1

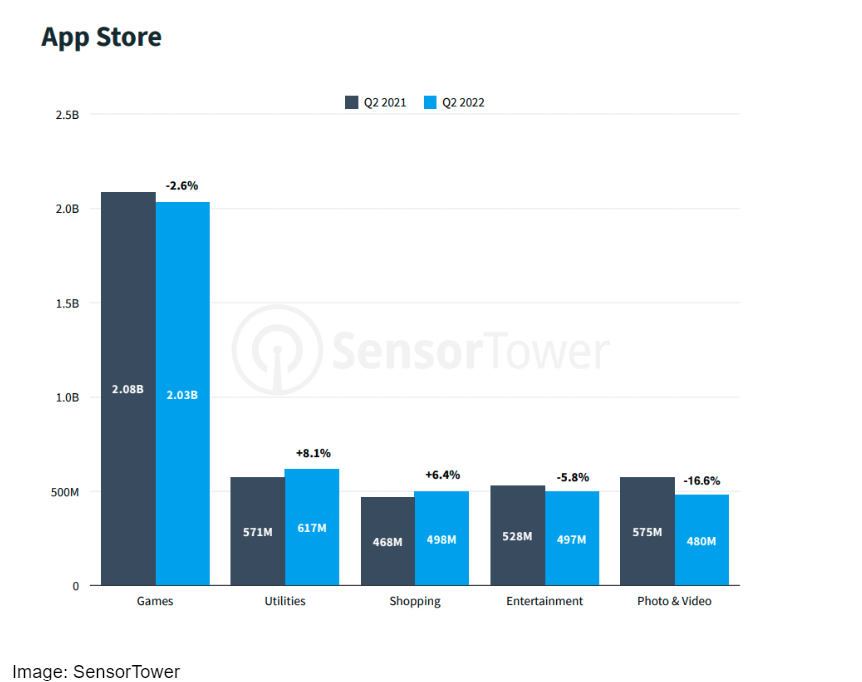

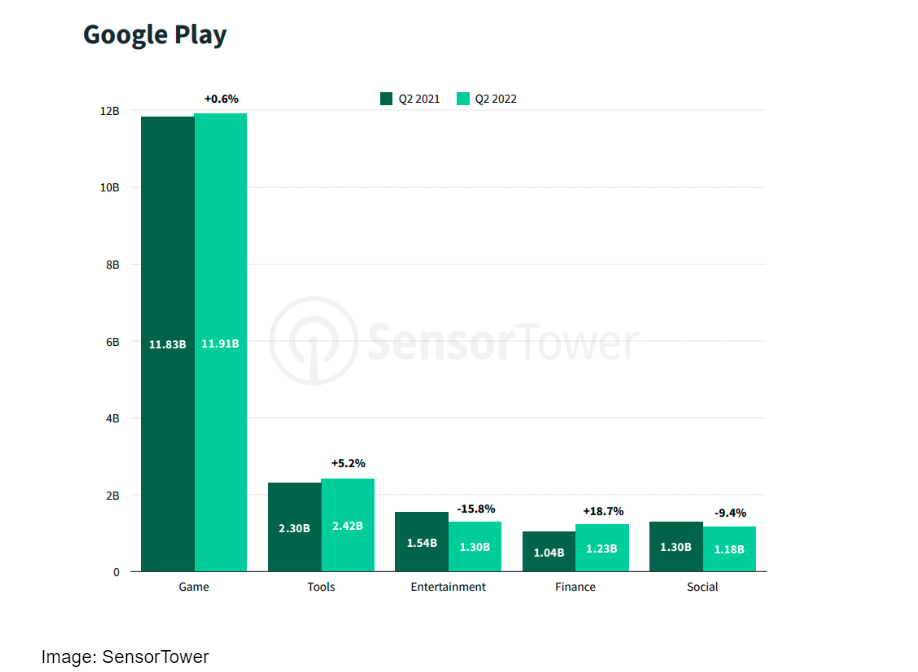

In our Q1 roundup, we noted that app downloads were mostly flat. The second quarter of the year revealed decreases in Apple and Google Play. Overall, there was 2.5% decrease, with Google Play registering a -2.9% loss and Apple a 1.3%.

However, there were areas of growth. Apple App store game downloads reverted to pre-pandemic levels, with a 2.6% dive, while utilities and shopping increased.

On Google Play, gaming downloads had a small bump, while entertainment and social saw losses. The category with the biggest jump was finance.

Key Takeaways:

- Utilities, shopping, and finance apps saw increased demand. As a result, you need to step up brand awareness and UA campaigns. Burst campaigns on the keywords associated with each are a good strategy to take advantage of likely higher search volume.

- The changes in app downloads appeared to represent leaving the pandemic behind. A higher need for utility apps may coincide with changing work habits. However, the pandemic created lasting adaptation with the increases in financial apps and m-commerce apps.

Amazon Loses Top Shopping App Spot in the U.S.

In overall downloads for the quarter, SHEIN dethroned Amazon, which had held that spot since Q4 2018. That’s an interesting development, as SHEIN is a Chinese-based fashion app. No other retail apps made the top 20. What does that mean for Amazon’s market growth? Are U.S. consumers facing Amazon fatigue?

Key Takeaways:

- Large retail apps have an opportunity to gain ground on Amazon; its fiercest competitors should be taking action to drive downloads in Q3 with CPI and CPE campaigns.

- Fashion brands should note this and study what makes the user experience in SHEIN attractive. By identifying these things, they can make strides to promote the same features in campaigns and on their app profile pages.

Apps for Travel and Events Have Impressive Quarter

Consumers are now traveling again in mass. As a result, they need travel tool apps to help them. The category had record high downloads in Q2 2022 in the U.S. and U.K. Airlines were big winners here. Some user influx could relate to airlines offering free movies and TV in-flight. The bring your own device option requires the app to stream.

Ticketing apps also have a reason to celebrate. Downloads in this category were up more than 70% over Q2 2019.

Key Takeaways:

- Travel and experiences are rebounding, and there is pent-up demand. If you have apps in these categories, you’ll need to work on retention plans to keep them engaged after the trip. If you provide value, they’ll stay.

- With inflation volatility, a word of caution is that these categories depend on discretionary spending. These are often the first things that get cut from a user’s budget, so stay aware of economic concerns.

Tap AdAction as Your UA Partner To Stay Up-To-Date

The biggest unknown in mobile app marketing is typically consumer shifts. Those needs are changing at a higher level, as we live in a digital world with more than its fair share of disruptions.

Mobile app marketers must respond to this continuously, and can do that better and with more success when you work with mobile app experts. Learn more about our solutions today and how we can deploy any campaign to a vast network.

You can also download our complete guide of solutions for mobile app marketers!